If you do not receive your renewal card by November 15th, please contact our Customer Service Division at (702) 455-3882. All responses must be submitted by the June 15th deadline.

CLARK COUNTY PROPERTY RECORDS HILTON ELARA CODE

To renew using the online program, use the access code printed on your renewal card. Renewal cards will be mailed beginning October 7th.

The Assessor's Office is excited to announce that all exemption holders may now renew their exemptions online. Strip is a stretch of South Las Vegas Boulevard in Clark County, Nevada.

Watch this video explaining Property Tax Cap percentages Hilton Grand Vacations Club Elara Center Strip Las Vegas - Orbitz WebApr 20. You have until Jto correct your tax cap for this year (2023-2024). It will only change if you make any changes to the ownership on your parcel (i.e. Once your property becomes your primary residence, your 3% tax cap is set for all billing years going forward. You will receive an amended bill from the Treasurer’s Office once your tax cap has been updated.Īs homeowners, you are always able to correct your tax cap if it is incorrect. If you returned a tax cap card to our office to have your property tax cap corrected, please be advised that the 3% tax cap may not immediately show on your tax bill due to the high volume of requests received. If your tax cap rate is stated incorrectly, please call the Assessor's Office at (702) 455-3882. You can also check your tax cap percentage by visiting the Treasurer's webpage. Property owners may submit a claim by signing the bottom portion of the letter and returning it to the Assessor's Office by mail, online, or in person. These property owners may be eligible for the primary tax cap rate for the upcoming fiscal year. The Assessor's Office mails out Tax Cap Abatement Notices to residential property owners who purchased property or had a change in ownership after July 1 in Clark County. Assembly Bill 489 provides for a partial abatement which limits annual tax increases on an owner's primary residence to no more than 3%, and for all other properties, no more than 8%. In 2005, the Nevada State Legislature passed a law to provide property tax relief. Below is a list of classes currently being offered:

CLARK COUNTY PROPERTY RECORDS HILTON ELARA HOW TO

The Assessor's Office staff offers classes instructing business owners how to complete online filing. If you did not receive a postcard by July 15, please call our Appraisal Division at (702) 455-4997. Personal Property postcards have been mailed to businesses of record as of July 1. If your account qualifies for installment payments, the declaration must be filed by July 31st. If you need to file before July 31st, please email your spreadsheet to or contact our office to receive an emailed declaration. It will take approximately two (2) minutes or longer for the map files to load using Adobe Reader.Due to the technical issues that have been occurring with the online filing system, we have granted extensions to file thru August 31 to all accounts that do not qualify for installments. You can also obtain the Road Document Listing in either of the Assessor's Office locations.

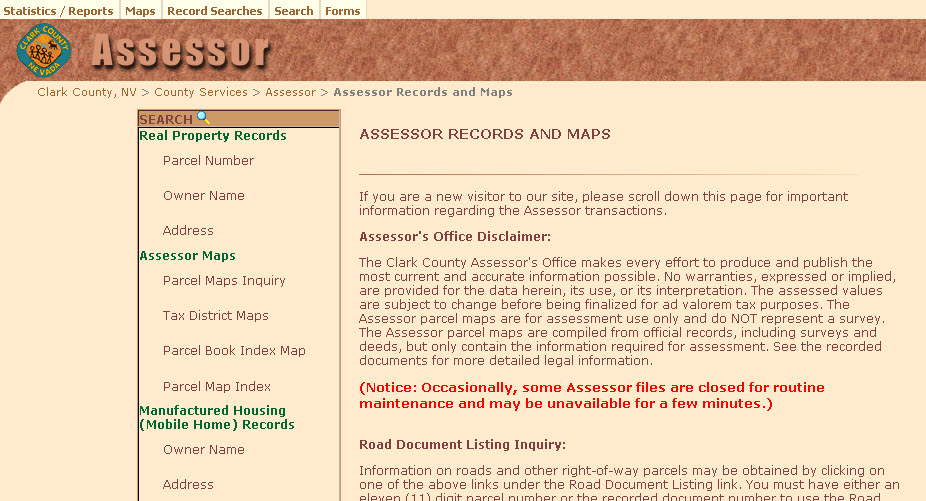

You must have either an 11-digit parcel number or the recorded document number to use the Road Document Listing transaction. Road Document Listing Inquiry: Information on roads and other right-of-way parcels may be obtained by one of the links under the Road Document Listing. (Notice: Occasionally, some Assessor files are closed for routine maintenance and may be unavailable for a few minutes.) See the recorded documents for more detailed legal information. The Assessor parcel maps are compiled from official records, including surveys and deeds, but only contain the information required for assessment. The Assessor parcel maps are for assessment use only and do NOT represent a survey. The assessed values are subject to change before being finalized for ad valorem tax purposes. No warranties, expressed or implied, are provided for the data herein, its use, or its interpretation. If you are a new visitor to our site, please scroll down this page for important information regarding the Assessor transactions.Īssessor's Office Disclaimer: The Clark County Assessor's Office makes every effort to produce and publish the most current and accurate information possible.

0 kommentar(er)

0 kommentar(er)